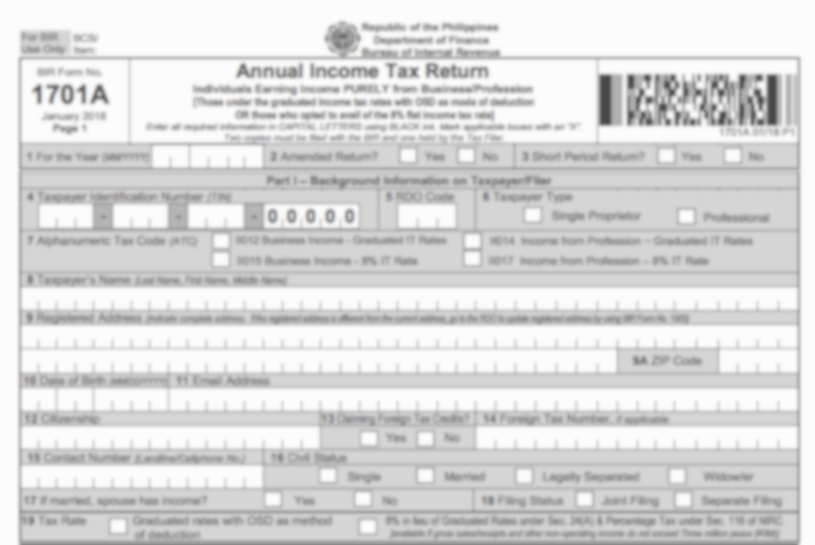

Here is a freelancer’s guide to filing an annual income tax return (1701A)

Filing my annual income tax return (ITR) was such a breeze! I took some pictures to show you how hassle-free it was. It literally took me a few minutes using eBIRForms.

Before filing your ITR, make sure that you:

- are already registered with BIR as a freelancer (self-employed professional) the previous year.

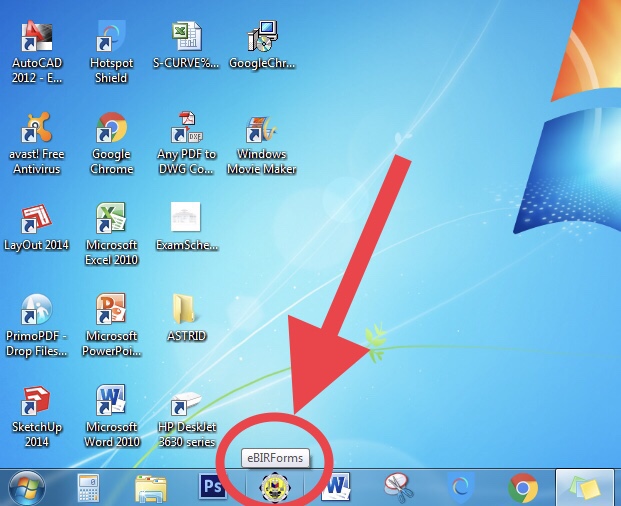

- install eBIRForms on your computer and have Internet access.

*After installing the eBIRForms Package, I pinned it to the task bar, so I could find it easily.

Freelancers, these are the easy steps to filing your ITR:

1. Open the eBIRForms portal

Click on the eBIRForms icon on your computer. If you don’t have the latest version, make sure to download the eBIRForms Package from the BIR’s official website.

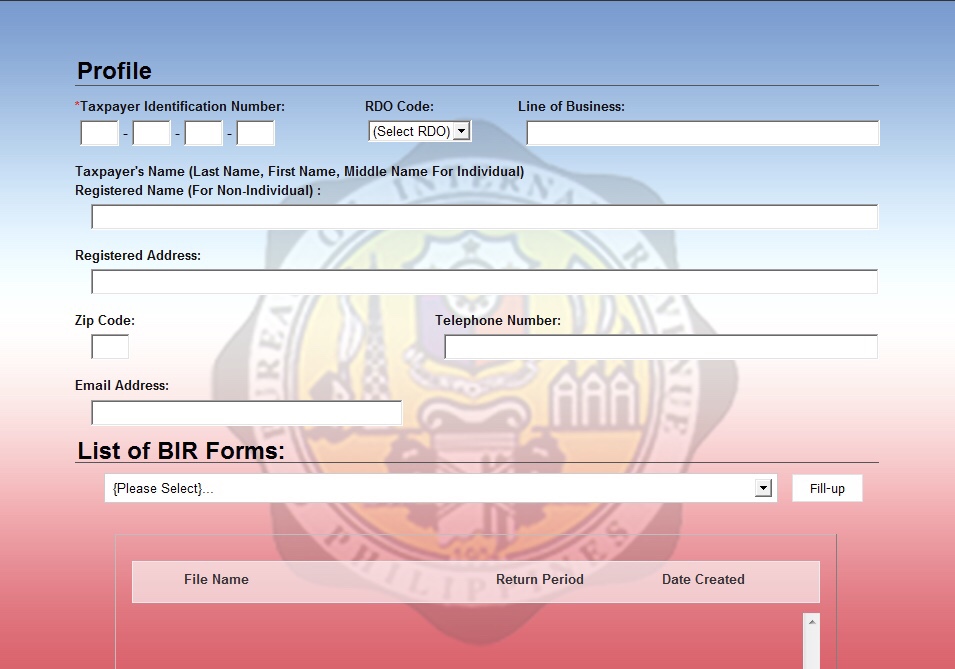

2. Fill in your information

Once inside the eBIRForms portal, fill in your tax information, such as your tax identification number (TIN). If you have used eBIRForms before, it will auto-populate after you input your TIN. Convenient, huh?

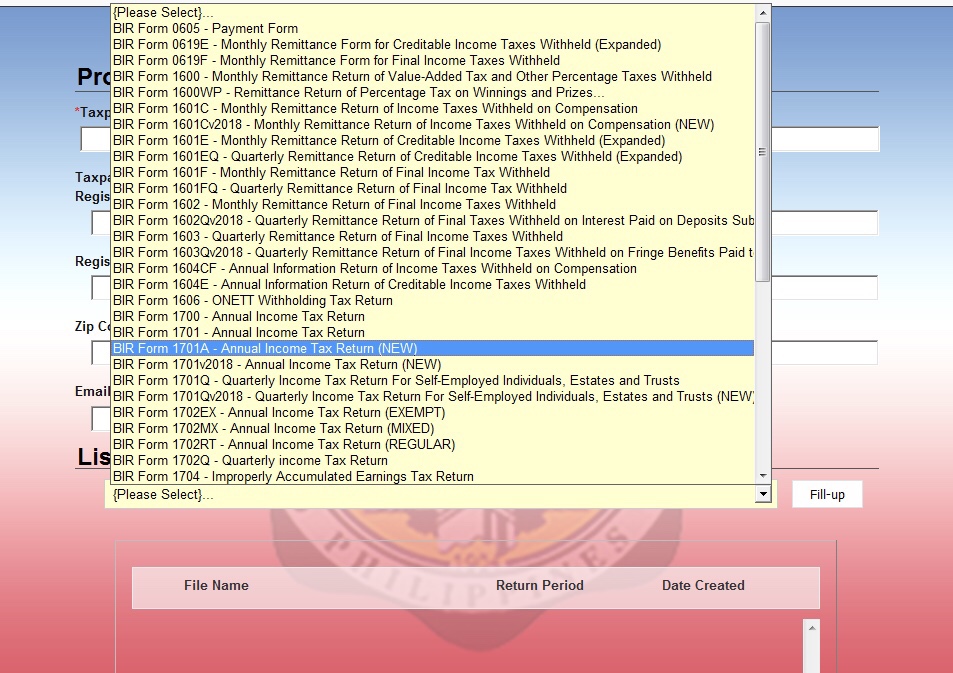

3. Select the appropriate form

See that List of BIR Forms on the image above? Click on the drop-down (drop-up?) menu and select BIR Form 1701A.

Click Fill-up (this is so disconcerting for me because it should not be hyphenated; even “up” is wrong in this context). Anyway, that’s the new form freelancers should use to file the annual ITR.

4. Fill out the form

Welcome to your eBIRForm 1701A! Simply fill out the form. Check out everything I have marked red on the image below.

*Item 1: The month should be December (12) and the year should always be the previous year.

*Item 19: Last year, I chose 40% optional standard deduction (OSD). It means I didn’t need to submit a list of my operational expenses and the receipts as proof (itemized deduction). Automatically, BIR would deduct 40% from my sales, another P250,000 (TRAIN deduction) and then compute my tax based on the difference (taxable income).

If you have a lot of expenses (such as phone, Internet and electricity bills, gasoline and other transportation expenses, computer, software and application purchases, dinners with clients and so on) that you think would help lessen your tax due, you can choose itemized deduction. You have to attach all receipts, so always keep them. Too much of a hassle for me.

5. Fill in your income details

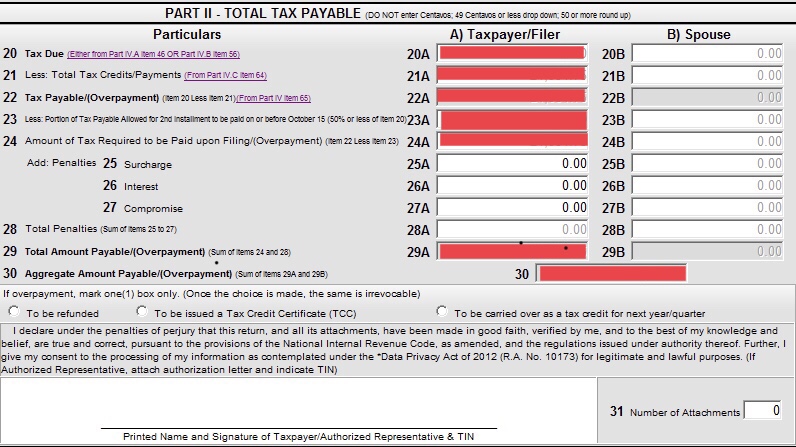

Go to item 20 Tax Due. Click on the link, which will take you to the second page.

6. Compute your tax due

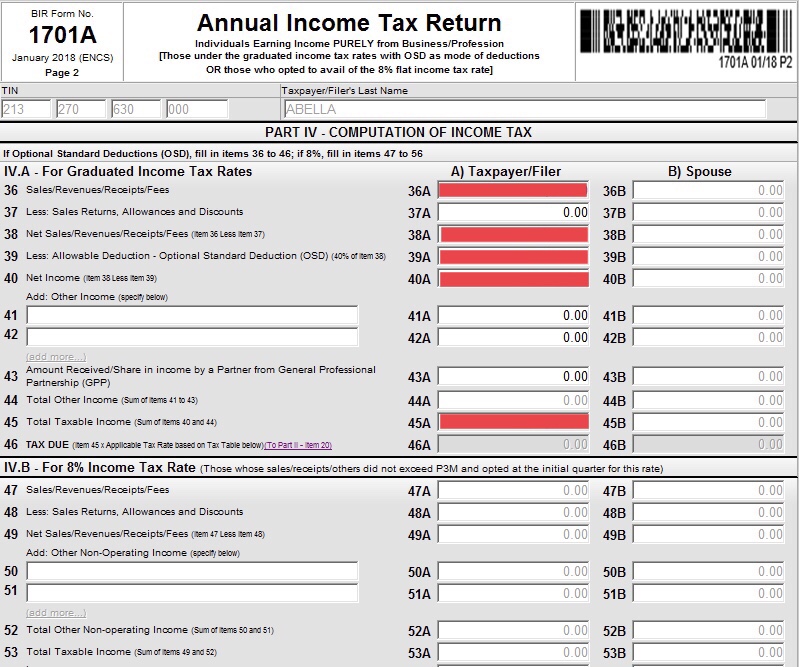

This is page 2, Part IV – Computation of Income Tax. I had opted for 40% OSD, so I just had to fill out the first portion, IV.A – For Graduated Income Tax Rates.

If you had chosen 8% income tax rate in the first quarter of last year, you need to fill out the second portion (IV.B).

7. Apply any tax credits

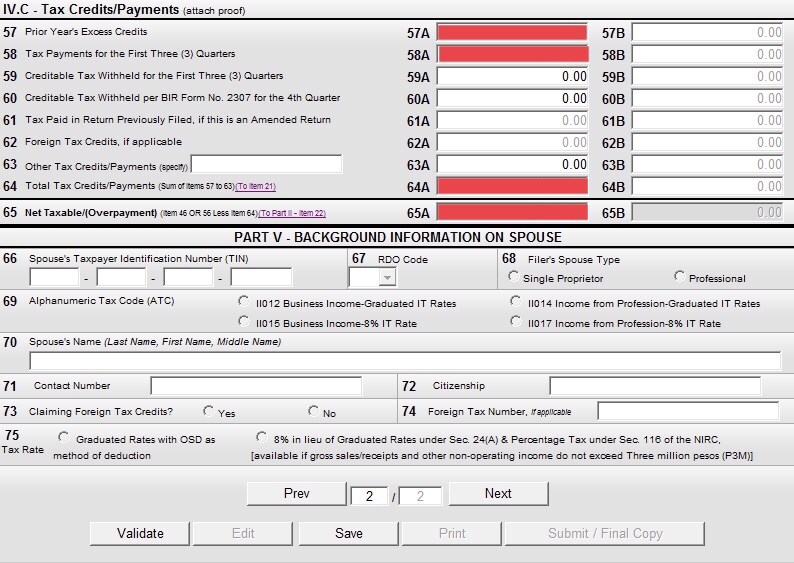

If you have any credits* from last year, for example, your tax due was in the negative (meaning, the government owes you), you can put them in the next portion, IV.C – Tax Credits/Payments.

*Item 57: Any negative tax due from your previous year’s ITR.

*Item 58: These are the payments you made when you filed your 1701Q for the first (Q1), second (Q2) and third (Q3) quarters.

*If you have Form 2307, you can include that in your tax credits, too.

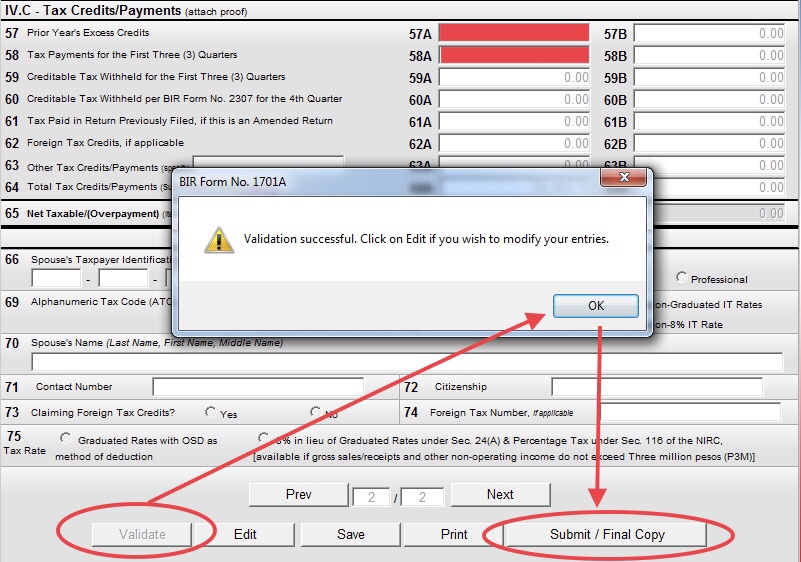

8. Review and validate

Now that you’ve filled everything you needed to fill in, click on the Validate button at the bottom of the page. If you’ve missed an item, a message box will appear, telling you which one it is. Just fill it and click “Validate” again.

Once everything’s good, you will see a box saying Validation successful. You could still edit your entries at this point. You can also click Save to ensure you don’t lose data in case of a power outage or loss of connectivity.

9. Submit your eBIRForm 1701A

When you are satisfied with your entries, click on the Submit / Final Copy button at the bottom of the page.

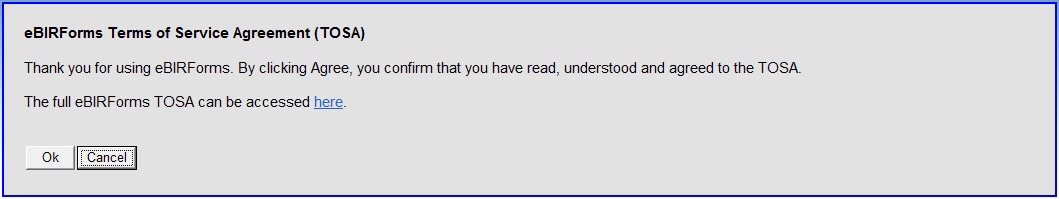

The Terms of Service Agreement (TOSA) box will appear. Read the TOSA quickly and then click Ok.

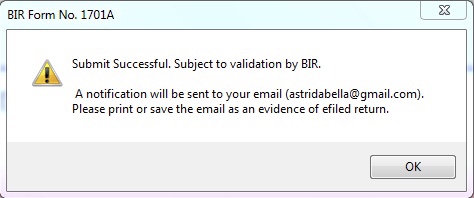

You will then receive a message box saying your submission was successful.

10. Print and sign your ITR

Print three copies and sign on the designated spaces to bring to the bank (or payment center) when you pay your tax due. I make sure I get each page in one letter-size (8.5in x 11in; short) bond paper for uniformity. I just adjust the scale to 80% or 90%, depending on how long the form is.

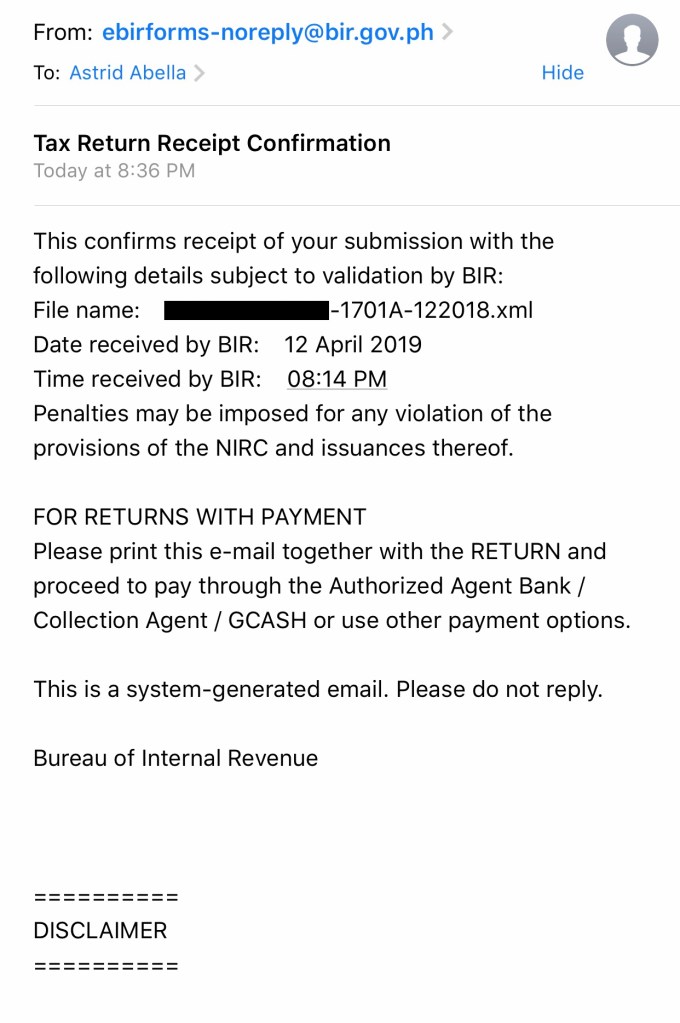

11. Wait for BIR’s confirmation email

Check your email in about 10 to 15 minutes for confirmation from BIR that it has received your ITR. Save or print the confirmation email for your records. It looks like this:

12. Pay your tax due

Pay your tax due through the available channels. I often pay by bank. Bring the printed copies, so the bank can stamp “received and paid” or something like that.

Keep the receipt and the stamped form. These are your proof in case the payment doesn’t post for some reason.

*If your tax due is zero or in the negative, good for you! You don’t need to do anything but wait for BIR’s email confirmation.

There you go! That’s all there is to it.

Congratulations on filing your ITR on your own. Isn’t adulting easy when you have all the information you need?

You can use your stamped ITR to apply for housing and car loans or whenever you need proof of financial capacity.

If you haven’t registered with BIR as a freelancer (whether you were previously employed or don’t have a TIN yet), you can read my steps on how to register with BIR as a freelancer.

TIPS

*File your ITR before the deadline (April 15) to avoid the rush, such as bank lines. It will also give you enough time to make changes, if needed.

*Always use the updated eBIRForms Package. You can download it from the BIR website.

*You can edit your eBIRForm as long as you haven’t submitted it yet. Even if you log out of your computer, the data will not disappear. This is recommended only if you own the computer. When using a public or shared computer (like at an Internet cafe), always delete your forms to protect your privacy.

*Pay by bank for immediate posting. GCash is another convenient payment method, but pay at least three working days before the deadline.

*BIR 1701A is for freelancers (self-employed professionals) and self-employed persons engaged in business who opted for 40% OSD or 8% tax rate and whose income does not exceed PHP 3 million (non-VAT). Your earnings must come from your freelancing/business only.

*Use BIR 1701 or another form if you are a mixed-income earner (employed + freelancer). Check with BIR which form you should use.

*Please verify any ambiguous information or anything not provided here with a BIR staff.