Previously, freelancers had to pay income tax and percentage tax (which had been changed from monthly to quarterly, thank God).

Income tax

The income tax return is filed using Forms 1701Q for the quarterly income tax and Form 1701A for the annual income tax.

You must also choose between itemized deduction and optional standard deduction (OSD).

In itemized deduction, you deduct all your operating expenses before your income is taxed. For freelancers, these would be your government contributions (SSS, PhilHealth, Pag IBIG), Internet bills, phone bills, computer hardware and software purchases, online tool subscriptions and anything you needed for work. You have to attach the receipts as proof.

Really, too much work for a lazy kid like me.

It seemed more convenient to go with 40% OSD. Just take 40% off your income and the BIR wouldn’t bother checking your receipts. A lot of work for them, too, I imagine.

Percentage tax (3%)

Percentage tax is something I really don’t comprehend. It’s a 3% tax imposed on businesspersons for the sales they make.

See, that’s what I don’t get. You get taxed when you sell something (percentage tax) AND THEN you get taxed when you get paid for it (income tax).

Let’s say I sold 10 articles a month for a total of PHP25,000. That’s PHP75,000 for three months. Every quarter, I would pay PHP2,250 quarterly percentage tax on those sold articles.

PLUS, I have to pay income tax for getting paid for selling those articles for which I was taxed for selling!

8% tax rate

Just when you thought you’re doomed with double taxation, along comes the 8% tax rate – a new option allowing you to pay only income tax. That’s right, no more percentage tax.

This year, I opted for the new 8% tax rate. I admit I didn’t really understand the benefits, but it just seemed like the more logical choice – no more percentage tax, just 8% of your total income.

So, does the 8% tax rate option really benefit you more?

After so many people asked me about it, I decided to see if it really does. For comparison, I tried computing the taxes of four monthly salaries in increments of PHP25,000. I studied the process and, honestly, once you get it (and when you have a tool), it’s kind of easy.

Before I show you the table I so painstakingly created, let me explain how it works.

How 40% OSD works

If your monthly income was PHP25,000, your quarterly income would be PHP75,000 (three months).

With 40% OSD, you need to pay income tax (1701Q + 1701A) and percentage tax (2551Q). Yes, that’s two kinds of taxes every year.

I haven’t figured out how 40% OSD quarterly income tax is computed yet, so I’m going to skip that 🙂

Computing the percentage tax is a no-brainer. It’s just 3% of your quarterly income.

- PHP25,00 x 3 months = PHP75,000

- PHP75,000 x 0.03 = PHP2,250

You pay PHP2,250 quarterly percentage tax in addition to your quarterly income tax.

The annual income tax (1701A) is easier. Just take your whole year’s income:

- PHP25,000 x 12 months = PHP300,000 annual income

Take 40% off the total.

- PHP300,000 – PHP120,000 (40%) = PHP180,000

Deduct PHP250,000 (this goes up as the income increases when using 40% OSD)

- PHP180,000 – PHP250,000 = –PHP70,000 (equivalent to PHP0)

Deduct all quarterly income tax payments you made for the same year. In this case, PHP0.

- PHP0 – PHP0 = PHP0 is your annual tax due based on 40% OSD

Basically, you pay nada. That’s because PHP25,000 is below the minimum taxable rate. With higher monthly incomes, the graduated tax rates go up.

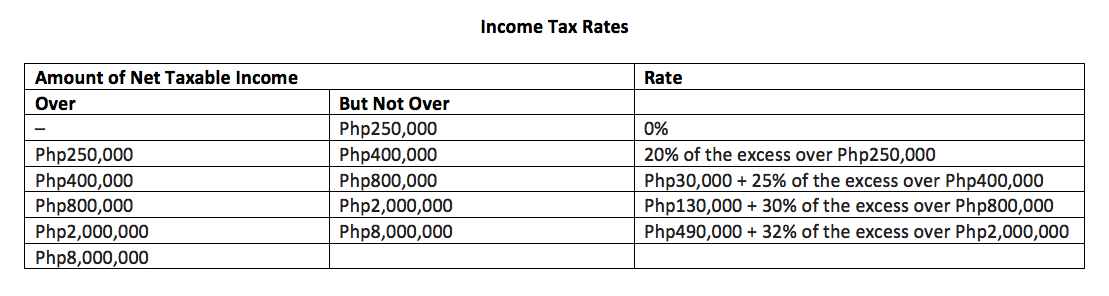

If you like computing and stuff, here you go.

How the 8% tax rate works

If you had chosen the 8% tax rate, you need only pay income tax. No more percentage tax. That’s why I chose it – less hassle!

Plus, the computation is very simple:

Every quarter, you pay 8% of your three-month income. Say, January to March:

- PHPp25,000 x 3 months = PHP75,000

Deduct PHP250,000 (allowable reduction) every quarter.

- PHP75,000 – PHP250,000 = –PHP175,000 (PHP0)

- PHP0 x 0.08 = PHP0 is your quarterly income tax due based on the 8% tax rate

For Q2, include your previous quarter’s taxable income (item 50) and your previous quarterly payment (item 56). If you have tax withheld (Form 2307), include those, too.

Rinse and repeat for Q3 (include both Q1 and Q2 data).

The final quarter (Q4) takes into account your whole year’s income, so it’s called the annual income tax return (1701A).

PHP25,000 x 12 months = PHP300,000 annual income

- PHP300,000 – PHP250,000 (allowable reduction) = PHP50,000

Then multiply it by 8%.

- PHP50,000 x 0.08 = PHP4,000 is your annual tax due based on the 8% tax rate

If you paid income tax for Q1, Q2 and Q3, include those payments as tax credits in item 58 to lower you tax due.

If your annual income tax due is in the negative, you not only don’t have any tax to pay, but the Philippine government even owes you!

Do you get a refund, though?

No.

It gets applied as tax credit on your next income tax return, and the next, and the next… until you’re back to square one paying tax dues again.

So which is better?

With 40% OSD, you would only pay a total of PHP9,000 percentage tax and PHP0 income tax because the income was below the taxable income threshold.

With the 8% tax rate, you pay a total of P4,000 annual income tax and no percentage tax for this option.

In total tax payments for the year, you pay PHP5,000 more with 40% OSD.

By comparison, the 8% tax rate is better than 40% OSD on a PHP25,000 monthly income.

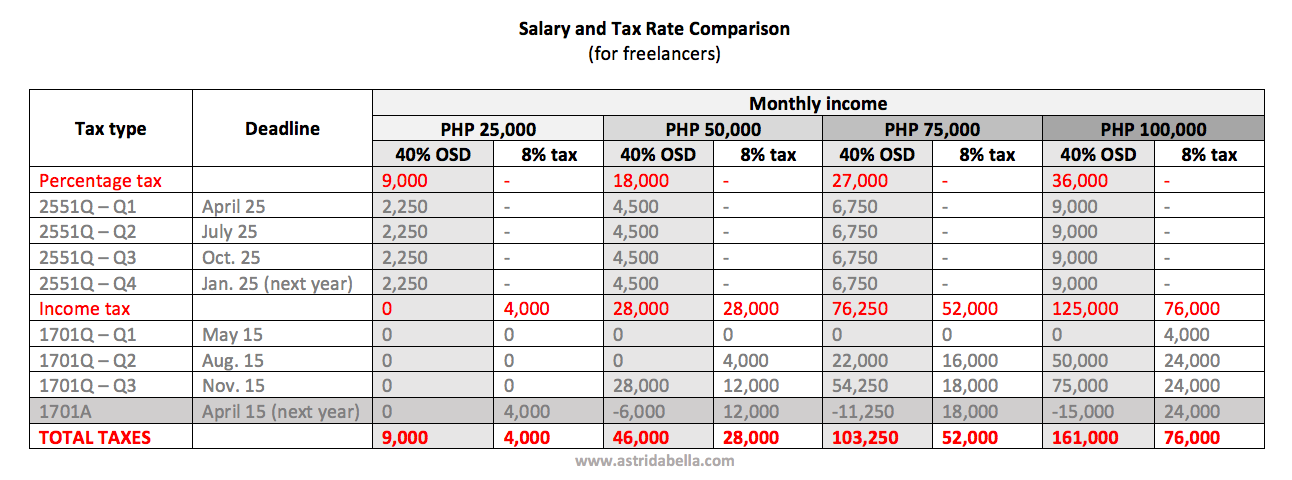

Let’s see if the same applies as your income goes up. Here is a comparison of four monthly income levels, namely, PHP25,000, PHP50,000, PHP75,000 and PHP100,000.

Click on the image to enlarge:

Relatively, as the income goes higher, the 8% tax rate becomes the even more sensible choice. Based on this comparison, higher incomes benefit more from the 8% tax rate.

Therefore, the 8% tax rate is the better option.

I hope the illustration above somehow helps you choose the right tax option for you and saves you a few pesos.

If you want to avail the 8% tax rate, you have until May 15 to update your preference using Form 1905.

One thing I noticed is that, with 40% OSD, the new tax forms result in high quarterly income tax dues for Q2 and Q3 for PHP50,000 monthly income and above, and then you get a negative come annual income tax filing.

If this is really how it’s going to be, it’s best to prepare for a big amount for Q2, and even more for Q3.

The good thing is that you can use the negative tax due to offset the following year’s taxes.

For those who opted for the 8% tax rate, the quarterly income payments are zero to minimal for Q1 and somewhat evenly spread out for Q2, Q3 and annual.

Note:

- All amounts are in Philippine pesos (PHP).

- Quarterly taxes (2551Q and 1701Q) are based on three months’ salary.

- The annual tax (1701A) is based on 12 months’ salary.

- No tax credits, 13th month pay, overtime and bonuses have been included in the computations.

- These computations apply to freelancers (self-employed professionals) only.

- These were computed on eBIRForms 2551Qv2018, 1701Qv2018 and 1701A.

- I did not include itemized deduction because there’s too much information needed. If you really want to do itemized deduction, make sure your deductibles account for more than 40% of your income.

- Always verify ambiguous information and those not mentioned here with a BIR staff or an accountant. I am not a tax expert; I’m just another taxpayer who tries to understand the process 🙂

Ready to pay your taxes? Here’s a guide on how to file an annual income tax return.

If you aren’t a registered taxpayer yet, read my simple guide on how to register with BIR as a freelancer. It’s really easy!